Imagine booking that dream vacation or scoring a first-class seat on a long-haul flight without breaking the bank. All thanks to a clever strategy involving credit card transfer bonuses. These bonuses can significantly amplify the value of your hard-earned points or miles, allowing you to save big on travel expenses.

In this guide, we’ll dive into the world of credit card transfer bonuses, explaining how they work, why they’re beneficial, and how you can leverage them to maximize your travel rewards. Whether you’re a seasoned points collector or just getting started, understanding how to use transfer bonuses effectively can make the difference between a good deal and a great one.

Let’s explore how you can use these bonuses to turn your travel dreams into reality without emptying your wallet.

Table of Contents

ToggleWhat Are Credit Card Transfer Bonuses?

Credit card transfer bonuses are a hidden gem in the world of travel rewards, offering savvy travelers the opportunity to stretch their points and miles further than they ever thought possible. But what exactly are these bonuses, and how can they help you score big savings on your next trip?

Basic Concept

In simple terms, a credit card transfer bonus is a promotional offer that gives you extra points or miles when you transfer your rewards from a credit card to a partner loyalty program, such as an airline or hotel chain. For example, if you transfer 10,000 points to an airline with a 30% bonus, you’ll end up with 13,000 miles in that airline’s frequent flyer program.

These bonuses typically range between 10% and 40%, although some offers can be even more generous. They are usually time-limited, lasting from a few weeks to a month, and are designed to encourage cardholders to transfer their points and miles to specific partners during the promotion period.

How Transfer Bonuses Work

Let’s break it down with a practical example. Suppose you have a credit card that earns Capital One Venture miles. Occasionally, Capital One may offer a transfer bonus, like a 20% bonus when you transfer your Venture miles to British Airways Avios. If you transfer 10,000 Venture miles, instead of getting a 1:1 transfer (10,000 Avios), you would receive 12,000 Avios thanks to the bonus.

The process generally involves logging into your credit card rewards portal, selecting the partner program you want to transfer your points to, and confirming the transfer amount. The bonus points or miles are typically added automatically during the transfer. However, there are a few airlines where it will take up to 48 painfully long hours.

Common Credit Card Programs with Transfer Bonuses

Not all credit card programs offer transfer bonuses, but the ones that do can provide significant value. Here are a few of the most popular programs (but not all of them) known for offering attractive transfer bonuses:

- American Express Membership Rewards: Frequently offers bonuses for transfers to airlines and airline partners like British Airways, Aeroplan, Flying Blue, and Delta, as well as hotel programs like Hilton Honors.

- Chase Ultimate Rewards: Known for bonuses to programs like United MileagePlus, Air Canada Aeroplan, Flying Blue, Marriott Bonvoy, and many more.

- Citi ThankYou Points: Offers occasional bonuses to partners such as Turkish Airlines, Air France/KLM, and Hilton Honors.

- Capital One Miles: You will see some transfer bonuses from their airline partners like Air France/KLM, Avianca, and Air Canda Aeroplan.

These programs partner with a variety of airlines and hotels, giving you multiple options to choose from based on your travel goals. Some airlines are included in multiple credit card transfer partners. So you see how things can be interesting if you have points and miles in each of the four major credit card companies.

Benefits of Using Credit Card Transfer Bonuses

Credit card transfer bonuses offer more than just extra points or miles—they present a strategic opportunity to get more bang for your buck when redeeming travel rewards. Let’s explore the key benefits and how they can significantly enhance your travel experience.

Maximizing Value from Your Points

One of the most compelling advantages of using transfer bonuses is the potential to maximize the value of your rewards. When a credit card issuer offers a bonus on point transfers, it effectively reduces the number of points needed to book flights, hotels, or other travel rewards.

For instance, a 30% bonus on transfers from Chase Ultimate Rewards to Air Canada’s Aeroplan can turn 50,000 points into 65,000 Aeroplan miles. This can be the difference between economy and business class on a long-haul flight.

These bonuses can achieve significant savings, particularly on high-value redemptions like business or first-class flights, enabling you to stretch your points further and book more luxurious travel experiences.

Real-Life Examples of Savings

To bring this to life, let’s consider a few real-world scenarios where transfer bonuses have led to substantial savings:

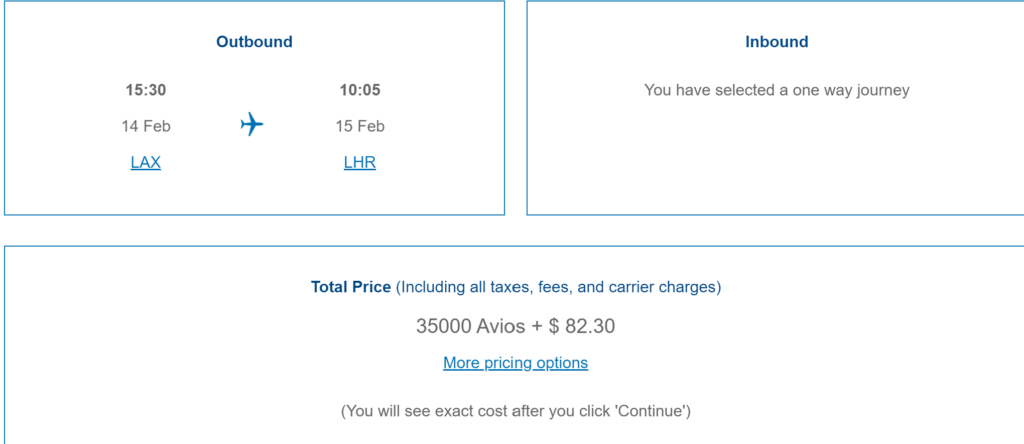

Chase Ultimate Rewards to British Airways – Economy: An economy flight from LAX to LHR is 35,000 Avios. With a 30% transfer bonus to British Airways Avios, it brings down the total amount of points needed at 25,000 (rounded up to nearest 1,000). Not a bad deal to get to London from Los Angeles.

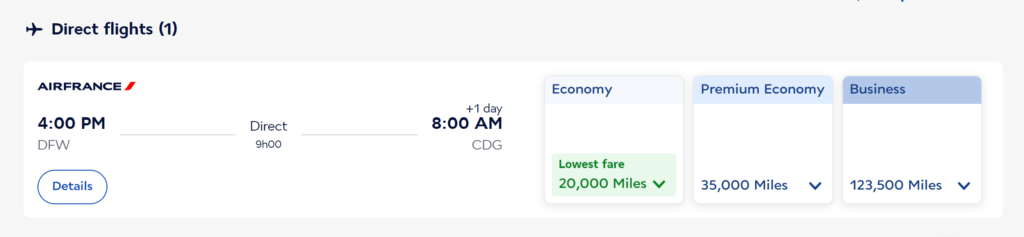

American Express Membership Rewwards to Flying Blue – Economy and Premium Economy: Flying Blue is the airline partnership for Air France and KLM. They typically have 20% transfer bonuses throughout the year. A flight from DFW to CDG will be 20,000 in economy and 35,000 in premium economy. With the transfer bonus, the total amount of points needed would be 16,000 (economy) and 28,000 (premium economy).

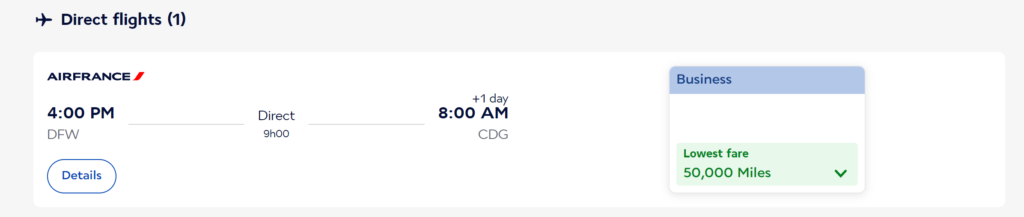

American Express Membership Rewwards to Flying Blue – Business: The better deal is finding great redemption flights on Air France in business class and stack those deals with a transfer bonus. That 50,000 business class flight would come out to 40,000 with a 20% transfer bonus.

- These examples highlight how strategic use of transfer bonuses can enhance your travel experience without requiring more points.

How to Identify and Use Transfer Bonuses

Identifying and effectively using credit card transfer bonuses can be a game-changer for maximizing your travel rewards. With a little strategy, you can turn these bonuses into substantial savings. Here’s how to stay on top of these offers and make the most of them.

Staying Updated on Transfer Bonuses

The first step in leveraging transfer bonuses is staying informed about when they’re available. These promotions are typically time-sensitive, so it’s crucial to act quickly. Here are some ways to keep yourself updated:

Sign Up for Alerts: Subscribe to our newsletter and keep in touch with our website. We will keep you updated on the latest transfer bonuses.

Sign Up For NewsletterCheck Credit Card Portals: Log in to your credit card rewards portal frequently. Issuers like Chase, American Express, and Citi often highlight current transfer bonuses on their rewards pages.

Calculating the Value of a Transfer Bonus

Not all transfer bonuses are created equal. To determine if a transfer bonus is worth it, you need to calculate the value of the bonus relative to your travel goals. Here’s a step-by-step guide:

- Know the Base Transfer Rate: Start by understanding the regular transfer rate between your credit card and the loyalty program. For example, Chase Ultimate Rewards typically transfer to Aeroplan at a 1:1 ratio.

- Apply the Bonus: If a 30% bonus is offered, multiply the number of points you plan to transfer by 1.3. So, if you’re transferring 50,000 points with a 30% bonus, you’d receive 65,000 Aeroplan miles.

- Assess the Redemption Value: Before transferring, check the redemption options in the loyalty program. For instance, if a business class flight costs 60,000 Aeroplan miles, and you’ve just gained 65,000 miles through a bonus, you can book that flight with room to spare.

- Avoid Over-Transferring: Transfer only the number of points you need for your intended redemption. You can only transfer those amounts in 1,000 points/miles increments. You may need to transfer a bit more to make sure you have enough points/miles to cover the price.

Best Practices for Redeeming Points with Transfer Bonuses

To truly capitalize on credit card transfer bonuses, timing and strategy are everything. Here’s how you can optimize your redemptions and make the most of these valuable promotions.

Timing Your Transfers

One of the golden rules of using transfer bonuses effectively is timing. Transfer bonuses are often available for a limited period, and aligning your transfers with your travel plans can significantly enhance the value of your points.

- Plan Around Major Promotions: Keep an eye out for recurring promotions or bonuses that align with your travel schedule. For example, if you know you’ll be booking a long-haul flight, wait for a transfer bonus to your preferred airline’s loyalty program before moving your points.

- Avoid Unnecessary Transfers: While it might be tempting to transfer points as soon as a bonus is announced, only do so when you have a clear redemption or flight in mind. Points often have more flexibility if they remain with the credit card issuer, where they can be transferred to various programs as needed.

Timing also involves considering the seasonality of travel and award availability. Certain times of the year might offer better award seat availability, allowing you to take full advantage of your bonus-enhanced points.

Potential Pitfalls to Avoid

While credit card transfer bonuses can offer fantastic value, there are a few common pitfalls that could diminish their benefits. Being aware of these will help you make smarter decisions when transferring your points or miles.

Over-Transferring Points

One of the most common mistakes people make is over-transferring points. When you transfer more points than you need, you might end up with excess points in a specific loyalty program. Unlike credit card rewards, which often allow for flexible redemptions across multiple partners, points in a loyalty program are generally locked into that specific program. This can limit your options and potentially leave you with unused points.

- Avoiding Over-Transferring: Before you initiate a transfer, carefully calculate the exact number of points you need for your intended redemption. However, also note that you may need to transfer a little more than expected. You can only transfer points/miles in increments of 1,000’s. If your needed points require you to transfer more, don’t over do it just to make sure..

Not Considering Transfer Times

Transfer times can vary significantly between programs, and this is another area where mistakes can happen. While some transfers are instant, others can take days or even weeks. If you’re planning to use a transfer bonus for a time-sensitive redemption, delays could result in lost opportunities.

- Check Transfer Times: Always check the expected transfer time before initiating the transfer, especially if you need the points immediately. Plan accordingly, and consider the timing when booking flights or hotels that have limited availability. Always have a plan “B” if the award availability is gone after your points have arrived in your account.

Conclusion

Credit card transfer bonuses are a powerful tool in any travel enthusiast’s arsenal. By understanding how they work, staying informed about current offers, and using them strategically, you can significantly enhance the value of your points and miles. Whether you’re aiming for a luxurious business class flight or a memorable stay at a top-tier hotel, these bonuses can make it all possible with fewer points than you might expect..

By following these guidelines, you’ll be well on your way to making the most of credit card transfer bonuses and achieving big savings on your travel adventures.

FAQs

How do I find out about new credit card transfer bonuses?

To stay informed about new credit card transfer bonuses, subscribe to our newsletters to get the latest on these transfer bonuses. Additionally, regularly checking your credit card’s rewards portal so that you can keep up on the latest offers.

Can I transfer points back to my credit card after moving them to a loyalty program?

No, once you transfer your points from your credit card to a partner loyalty program, the transfer is final. This is why it’s crucial to calculate the exact number of points needed for your desired redemption before initiating the transfer. Over-transferring can leave you with excess points in a program where they may not be as useful.

What happens if a transfer bonus ends before I transfer my points?

If a transfer bonus ends before you initiate your transfer, you will not receive the bonus, and your points will transfer at the regular rate. It’s important to keep an eye on the expiration dates of these promotions and act within the bonus period to take advantage of the offer. Planning and timing are key to maximizing these bonuses. Before you click the button to transfer, you should see a “transfer bonus” next to the airline partner.