You know, the idea of paying a yearly fee just to own a credit card can make folks wrinkle their brows faster than an unexpected Monday morning meeting. And honestly, I get it. Why shell out cash before you’ve even started spending? But here’s the thing. Credit card annual fees often unlock doors to perks, rewards, and bonuses that far outweigh the cost. If you play your cards right (pun absolutely intended), you can see how you can justify those credit card annual fees.

People often ask, “How can I justify credit card annual fees?” The answer boils down to this: it’s not about the fee itself but what you get in return. With a strategic approach, you can actually use those perks to save more than what you spend on the fee. Let’s dive into how you can turn that annual cost into a ticket for maximum benefits.

Table of Contents

ToggleMaximizing Welcome Bonuses

When it comes to justifying credit card annual fees, welcome bonuses often provide the biggest bang for your buck, especially in the first year. These bonuses can sometimes cover the entire fee and still leave you with plenty of rewards to spare. But to get the most out of them, you need to understand how they work and make sure you can meet the spending requirements.

What Are Welcome Bonuses?

Welcome bonuses are large, one-time point or cashback offers that credit card companies use to attract new cardholders. Typically, these bonuses require you to spend a certain amount, usually within the first three months of account opening.

For example, the Chase Sapphire Preferred card offers 60,000 bonus points after spending $4,000 in the first three months. Those points can be worth up to $750 when redeemed for travel through the Chase Ultimate Rewards portal. Or could be up to $1,200 or more if transferred to one of Chase’s airline transfer partners.

Similarly, the American Express Platinum Card offers a whopping 80,000 Membership Rewards points after spending $8,000 in the first six months, valued at more than $1,600 in travel redemptions if you transfer the points to Amex’s airline transfer partners.

These bonuses can easily make up for, or even exceed, the annual fee, giving you tremendous value from the outset.

How to Calculate the Value of a Welcome Bonus

When determining if a welcome bonus offsets the annual fee, it’s important to calculate the value of the points or cashback earned. As a rule of thumb, your welcome bonus value should be at least three times the annual fee.

For travel cards, the value of points can vary depending on how you redeem them. For instance, with Chase Ultimate Rewards, points can be worth 1.25 to 1.5 cents each when redeemed for travel through the Chase travel portal. That means the 60,000 points from the Chase Sapphire Preferred card could be worth $750 towards flights or hotels. Now this value can be up to $1,200 or more if you are able to redeem these points through one of Chase’s airline transfer partners. That makes your points worth 2 cents. And depending on the flight, could be up to 10 cents per point!

Key Tip: Spending Smart to Earn Welcome Bonuses

While the welcome bonuses can be tempting, the spending requirements are often hefty. Most cards with significant bonuses require spending between $3,000 and $5,000 within the first three months. That’s why it’s crucial to plan how you’ll meet this requirement without overspending.

A great way to hit that spending threshold without changing your habits is by using your card for regular expenses like groceries, gas, or utility bills. Some people also time large, planned purchases (like a vacation or home renovation) around the opening of a new credit card to make sure they can meet the requirement comfortably. Another strategy is to prepay for recurring services, such as gym memberships or subscription services, using your credit card to hit that threshold.

Ultimately, the trick is to only use the card for expenses you’d already make—avoiding the pitfall of overspending just to hit the bonus requirement.

Leveraging Everyday Spending Rewards

Now, here’s where the real magic happens, earning rewards through everyday spending. If you’re looking to justify credit card annual fees long-term, maximizing these everyday rewards categories is key. It’s not just about getting that big welcome bonus in the first year. It’s about earning rewards with every swipe.

Understanding Rewards Categories

Most credit cards offer rewards in specific spending categories like dining, groceries, gas, or travel. For example, the American Express Gold Card gives 4x points at restaurants and on up to $25,000 spent annually at U.S. supermarkets. Similarly, the Citi Premier Card offers 3x points on travel, gas stations, and dining. These points can add up quickly, especially if the card matches your daily spending habits.

How to Maximize Points from Everyday Purchases

The key to justifying that annual fee is using the card strategically in its top-earning categories. If your card offers bonuses on dining, make sure to use it every time you eat out or grab takeout. For groceries, cards like the American Express Gold Card offer 4x on up to $50,000 spent annually at U.S. supermarkets.

Using your card for routine purchases not only ensures you’re racking up rewards, but it also helps offset the cost of the annual fee. Whether you’re paying for your morning coffee, filling up your gas tank, or even paying utility bills (for cards that allow it), every dollar spent brings you closer to reaping the full benefits of your card.

Real-Life Example: Calculating Points for Value

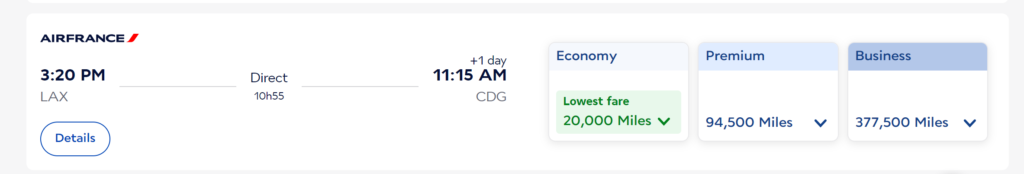

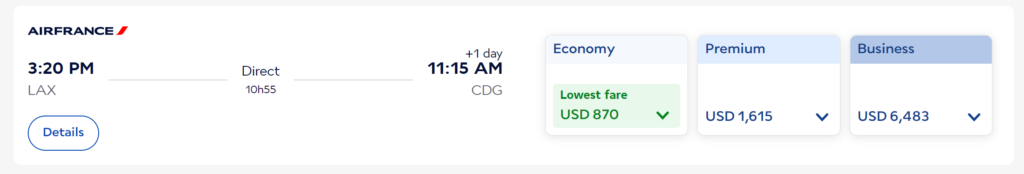

Let’s say you’re using the Amex Gold Card, which gives 4x points on dining. If you spend $500 a month on dining out, that’s 2,000 points each month. In a year, that adds up to 24,000 points. You then transfer 20,000 points to Air France, one of Amex’s airline transfer partners. You book a flight from LA to Paris for 20k points plus $99 in fees. That flight is regularly $870. Your redemption would be amost 4x. If you calculate your total return on investment, you would be getting $0.16 per each dollar spent. A great value of your annual dining out expenses. And who wouldn’t want to go to Paris for almost free just from your typical dining expenses.

Credit Card Perks and Credits That Offset Annual Fees

When justifying a credit card’s annual fee, one of the most convincing arguments lies in the additional perks and credits that directly offset the cost. These perks go beyond simple rewards points and offer tangible value in the form of credits for specific purchases, travel benefits, and other unique protections.

Statement Credits for Travel, Dining, and Subscriptions

Many premium cards offer credits that are automatically applied to common expenses, significantly reducing the overall cost of the card. For example, the American Express Gold Card provides up to $120 in dining credits annually ($10 per month) for eligible restaurants and food delivery services, plus another $120 in Uber credits split monthly, another $100 per year on Resy restaurants, and $87 per year for Dunkin Donuts. These credits alone exceed the card’s $325 annual fee.

Similarly, the Chase Sapphire Reserve offers a $300 annual travel credit, which is applied to a broad range of travel purchases, from airfare to hotel stays and even Uber rides. For frequent travelers, this one perk can effectively bring the card’s hefty $550 fee down to $250.

Valuable Perks Like Insurance and Purchase Protections

Beyond statement credits, premium cards often include various types of insurance and purchase protections that can save cardholders a significant amount of money. For instance, many cards, like the Chase Sapphire Preferred, offer primary rental car insurance, which means you don’t need to purchase additional insurance when renting a car. The card also comes with trip cancellation insurance, lost luggage reimbursement, and extended warranties on eligible purchases.

These perks can be extremely valuable, especially in emergency situations, and often justify the annual fee for those who travel frequently or purchase high-value items.

Calculating the Overall Value of Perks

The key to justifying an annual fee through these perks is simple. You have to use them! If you’re taking advantage of travel credits, dining credits, insurance, and protection features, the total value of these benefits can easily exceed the fee. By understanding how to fully leverage these perks, you’ll find that many credit cards provide far more in value than they charge annually.

Amex credits take a little bit of work to get the full benefit of the credits. But it can be done and your annual fees won’t feel that bad. Especially when your in Paris, right?

Calculating the Break-Even Point on Fees

Alright, now that we’ve covered the bonuses, rewards, and perks, let’s get down to the math: how to calculate the break-even point for your credit card’s annual fee. This is where we crunch the numbers to see if the value you’re getting from rewards and benefits truly justifies that fee.

How Much Do You Need to Spend to Break Even?

One of the most effective ways to justify an annual fee is by determining how much spending is required for your rewards to cover the cost. Every credit card offers a different points-per-dollar ratio based on categories like dining, travel, or groceries. For example, the Chase Sapphire Preferred offers 3x points on dining and 2x points on all travel purchases.

Let’s take a practical example: If the Chase Sapphire Preferred has an annual fee of $95, you’d need to earn enough points to cover that fee. Here’s how you can calculate it:

- If dining earns 3x points per dollar, and those points are worth about 1.25 cents each when redeemed for travel through the Chase portal, you’ll need to spend about $2,533 on dining annually to break even on the fee ($95 ÷ 0.0375). That’s $200 per month for dining.

- This card also earns 3x points per dollar at US grocery stores. The same math can be applied to this spending category. And if you use this card for both dining and groceries, the break even would be $100 each month in dining and groceries. And if you’re like us, we spend more than $100 for each trip to the grocery store.

Similarly, for cards like the American Express Gold Card that offer multiple perks (e.g., dining credits), you can use those credits and the points earned to calculate whether the rewards exceed the fee.

Tailoring Cards to Your Lifestyle

When it comes to justifying credit card annual fees, there’s one golden rule: choose a card that fits your lifestyle. The biggest mistake people make is picking a card with perks and rewards that don’t match how they actually spend. So, let’s break down how you can make sure your card aligns with your day-to-day life and habits.

Matching Card Benefits with Your Spending Habits

Every card comes with a unique set of benefits, but to get the most out of the annual fee, it’s crucial to pick one that offers rewards where you spend the most. For example:

- If you dine out frequently or spend big on groceries, the American Express Gold Card might be your best bet, with 4x points at U.S. supermarkets and restaurants.

- If you’re a frequent traveler, a card like the Chase Sapphire Reserve, which gives 3x points on travel and dining, plus perks like lounge access and a $300 travel credit, could justify its higher fee.

By choosing a card that rewards you for purchases you already make, you can easily justify the annual fee.

Avoid Paying for Unused Benefits

While premium cards pack a lot of perks, not all of them will apply to everyone. For instance, cards that offer free hotel stays or lounge access are great, if you travel often. But if you rarely stay at hotels or fly, those benefits might be wasted, making it harder to justify paying for them.

Think about what benefits you’ll actually use. If you’re paying for a card that comes with luxury travel perks but never fly or stay in hotels, it may be time to consider downgrading to a card that better fits your lifestyle.

Choosing the Right Card for Your Financial Goals

Beyond your spending habits, consider your overall financial goals. If you’re focused on building credit, a card with a low annual fee or no annual fee, but with steady rewards on routine purchases, may be the best fit. On the other hand, if you’re aiming to maximize rewards for travel, premium cards with higher fees but bigger rewards might suit you better.

Annual Fees Beyond Year 1 – Are They Still Worth It?

Once you’ve gotten through that exciting first year with your new credit card, and cashed in on those juicy welcome bonuses, the real question arises: Is the annual fee still worth it in year two and beyond?

Evaluating Ongoing Value Without the Welcome Bonus

The first year of owning a premium credit card often feels like a great deal. The welcome bonus alone usually more than covers the annual fee. But after year one, you no longer have that large bonus to rely on, so the focus shifts to whether the ongoing perks and rewards can still justify the fee.

To determine if the card is still valuable in subsequent years, you should consider the following:

- Ongoing Reward Rates: Many cards offer high reward rates in key spending categories like groceries, dining, or travel. For example, the Chase Sapphire Reserve offers 3x points on dining and travel, while the American Express Gold Card gives 4x points at U.S. supermarkets and restaurants. If your regular spending aligns with these categories, you can still accumulate points that justify the fee long-term.

- Annual Credits: Some credit cards offer annual credits that offset the fee each year. For example, the Chase Sapphire Reserve provides a $300 annual travel credit, which instantly reduces its effective fee from $550 to $250. The American Express Platinum Card includes a wide range of credits—from airline fee credits to Uber and Saks Fifth Avenue credits—that, when fully utilized, can exceed the $695 annual fee.

- Exclusive Perks and Protections: Perks like airport lounge access, travel insurance, purchase protection, and extended warranties can continue to provide significant value after year one. Frequent travelers, in particular, might find these benefits easily justify paying the fee, as they can save hundreds of dollars in other travel expenses.

Is the Card Aligned with Your Current Spending?

As your spending habits evolve, the value of your credit card may change too. Maybe you’re no longer dining out as often or have cut back on travel. If the card’s reward categories no longer align with your spending, it might be time to rethink whether you need a high-fee card or if a no-fee alternative might be a better fit.

When Downgrading or Canceling Might Make Sense

If you find that you’re not fully utilizing the perks and rewards in year two and beyond, it might be worth considering downgrading to a no-fee version of the card. Many credit cards allow you to downgrade without losing your credit line or hurting your credit score. Alternatively, canceling the card is an option, but keep in mind that closing a credit account can impact your credit utilization ratio and overall score.

The Bottom Line: Weigh the Perks Against the Fee

Ultimately, after year one, the value of paying an annual fee comes down to how much you’re using the ongoing perks, credits, and rewards. If you’re maximizing the benefits, the fee can still be well worth it. However, if you’re not utilizing the card’s features, it might be time to reassess and consider alternative options.

Final Thoughts: Is the Annual Fee Worth It?

So, after diving into all these perks, rewards, and benefits, the big question remains: Is paying a credit card annual fee actually worth it?

The answer depends on how well the card aligns with your spending habits and lifestyle. If you’re maximizing welcome bonuses, racking up rewards on everyday spending, and using statement credits and card perks, the value you gain will often exceed the annual fee. Essentially, the key to justifying these fees is to make sure you’re using every feature your card offers.

At the end of the day, paying an annual fee isn’t just about the privilege of owning a fancy card. It’s about making sure the rewards and perks provide value that works for you. Pick the right card, track your spending, and make sure the benefits truly outweigh the costs.

FAQs: Frequently Asked Questions About Credit Card Annual Fees

Can I negotiate my credit card’s annual fee?

Yes, some issuers allow you to negotiate the annual fee after the first year. You can try calling the card provider, especially if you’ve been a long-time cardholder. Sometimes they’ll offer a fee waiver, reduce the fee, or even provide additional statement credits to retain your business.

Do I still get the same benefits if I downgrade my card to avoid the fee?

No, downgrading your card typically means you’ll lose access to premium benefits, such as airport lounge access, enhanced reward rates, or travel credits. However, some no-fee versions of cards still offer decent rewards and perks without the annual fee.

Will canceling a credit card with an annual fee hurt my credit score?

Canceling a credit card can impact your credit score, mainly through factors like credit utilization and the length of your credit history. It’s important to consider how closing the card will affect your overall credit profile before making the decision.

What is the difference between no-fee and annual fee credit cards?

No-fee cards generally offer fewer perks and lower reward rates compared to cards with annual fees. Cards with fees often provide larger welcome bonuses, better reward multipliers, and additional perks such as travel credits, insurance protections, and exclusive access to lounges.

Are there any cards where the annual fee isn’t worth it?

This depends entirely on how you use the card. If you aren’t maximizing the rewards or taking full advantage of perks like travel credits or bonus categories, then the fee might not be worth it. Always make sure the benefits of the card align with your spending habits and travel plans. Stockpiling a ton of points is not the ideal thing to do. But that’s for another blog post.