Considering the American Express Gold Credit Card for your wallet? You’re in the right place. In this review, we’ll delve deep into the nitty-gritty of what makes the Amex Gold Card shine and if it’s worth its weight in, well, gold for you in 2023/24.

From outstanding dining credits to travel perks that can quickly increase the number of points in your bank, the American Express Gold Card has been setting the standard for premium credit experiences. This card is a top travel card that earns Membership Rewards points. These points can quickly add up with its high earning rates for dining and groceries. But, with its hefty annual fee, is it the right financial move for you? Let’s break down the benefits, rewards, and features to help you make a well-informed decision.

Table of Contents

ToggleAmerican Express Gold

- Welcome offer – 60,000 points when you spend $6,000 in the first six months.

- Annual fee – $250

- Earn 4x points on dining and supermarkets

- $120 dining credit

- No foreign transaction fee

Advertisement and Editorial Disclosure

This website features mentions of products from our advertising partners. We may earn a commission when you click on links to these products. Specific terms and conditions apply to the promotions highlighted on this page. To understand more about our Advertising Policy, please refer to this dedicated page.

Overview of the American Express Gold Credit Card

The American Express Gold Card is a premium credit card known for its strong rewards in dining and travel categories. It offers a substantial points system for purchases at restaurants, supermarkets, and on flights booked directly with airlines or through American Express Travel. Additionally, the card comes with various travel and dining perks, making it a popular choice for frequent travelers and food enthusiasts.

Key Features and Benefits

The American Express Gold Card is more than just a prestige item—it’s a tool that can add value to every dollar you spend if used correctly. Let’s dive into the key features and benefits that contribute to its appeal.

Earning Rates:

- Dining: Earn 4X Membership Rewards points at restaurants, including takeout and delivery.

- Supermarkets: Rake in 4X points at U.S. supermarkets on up to $25,000 per year in purchases (then 1X).

- Flights: Secure 3X points on flights booked directly with airlines or on amextravel.com.

- Everything Else: All other purchases on your card will net you 1X points.

Welcome Offer:

New cardholders have a chance to earn a generous welcome bonus. Currently, American Express is offering 60,000 points after spending $6,000 in first six months of card membership.

Annual Fee:

$250 – At first glance, the card’s annual fee may induce a bit of sticker shock—it’s not insignificant. However, when you break down the benefits and rewards, it’s possible to recoup this cost and then some with the card benefits, provided the card aligns with your spending patterns.

Tip: Maximizing your benefits requires aligning your spending with the card’s earning categories. With the Amex Gold, that includes dining and groceries.

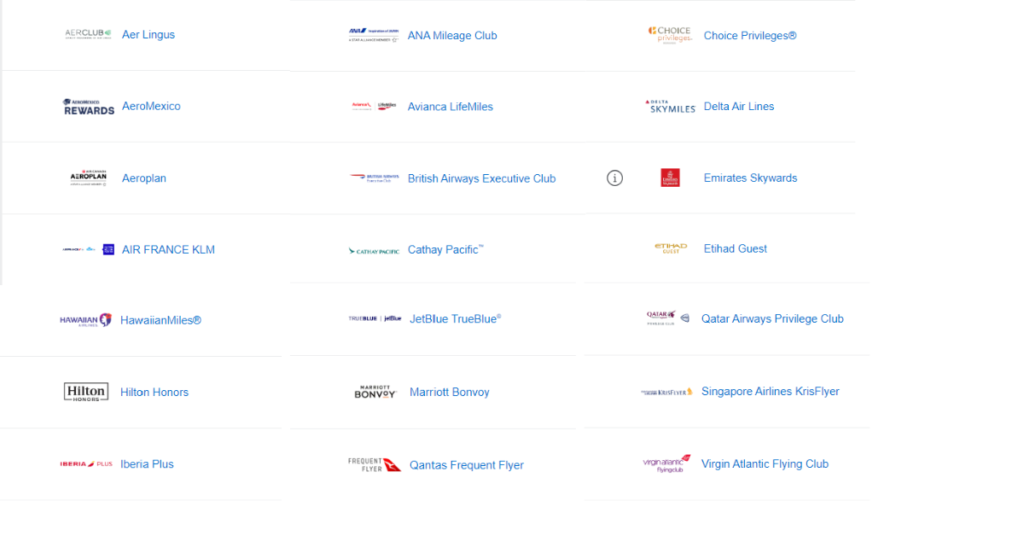

American Express’ Transfer Partners:

American Express Membership Rewards program offers a variety of travel partners, including 18 airlines and 3 hotels, where you can transfer your Membership Rewards points. Some of the partners include Delta, Air Canada, Hilton, JetBlue, and our favorite, Air France/KLM. Most of these partners transfers Membership Rewards 1:1, but on occasions, American Express will have increased transfer bonuses that increases that amount up to 30%.

Additional Perks and Benefits

Apart from its impressive rewards structure, the American Express Gold Card is brimming with additional perks that can elevate your spending experience to luxe heights. Let’s take a closer look at some of these enticing extras.

Dining Credits – Tantalize Your Taste Buds:

- Receive up to $120 in dining credits annually ($10 monthly) at select restaurants and food delivery services. We typically order Chipotle with Uber Eats for this credit.

- Participating partners often include popular chains and services, such as Grubhub and The Cheesecake Factory.

Travel Benefits – Journey with Peace of Mind:

- Baggage Insurance: Protect against lost, damaged, or stolen baggage.

- No Foreign Transaction Fees: Spend internationally without pesky additional charges.

- The Hotel Collection: Enjoy room upgrades and a $100 hotel credit on qualifying charges when booking through Amex Travel.

Whether it’s for business or leisure, these travel perks ensure that your adventures come with a safety net and a dash of luxury.

Other Exclusive Benefits

- Exclusive Events: Gain access to presale tickets and member-only events, perfect for those who relish live entertainment.

- Shopping Protections: Benefit from purchase protection and extended warranties on eligible items.

Each benefit adds a layer of value, making every dollar spent work a little harder for you.

Pros and Cons

When contemplating the American Express Gold Card as your potential financial companion, it’s crucial to consider both sides of the coin. Here, we examine the advantageous features alongside some potential downsides.

Amex Gold Pros

- 4X points on dining and supermarkets.

- 3X points on flights,

- $120 in annual dining

- Baggage protection

- No foreign Transaction Fees

- Flexible points

- Excellent Customer Service

Amex Gold Cons

- $250 Annual Fee

- Need high credit score

- No lounge access

American Express Gold Card vs Chase Sapphire Preferred

Our recommendation when first entering into the travel hacking game is to start off with the Chase Sapphire Preferred. However, a close second, and depending on the enhanced welcome offer that American Express often makes, the American Express Gold can be a good option for one of your first travel credit cards.

User Experience

The journey with your American Express Gold Card begins long before your first swipe or tap. From the moment you consider applying, your experience matters. Here’s what you can expect in terms of usability and customer service with the Amex Gold.

Application Process:

Applying for an American Express Gold Card is typically straightforward. You can do it online in a matter of minutes. The process includes:

- Filling out the application with personal and financial details.

- Submitting the application and waiting for a credit check.

- Receiving an instant decision or, in some cases, waiting a few days for further review.

Tip: Have your financial information handy for a smoother application process.

Online and Mobile Account Management:

- User-Friendly Interface: Both the website and mobile app are intuitive, making it easy for you to monitor account activity, redeem points, and manage benefits.

- Helpful Tools: Features like spending trackers and payment reminders help you stay on top of your finances.

- Security: Robust security measures protect your sensitive information.

Customer Service Experience:

- 24/7 Availability: Help is always available, ensuring round-the-clock support.

- Multiple Contact Options: Whether you prefer to call, chat, or email, you’re covered.

- Concierge Services: Beyond problem-solving, concierge services help with travel and dining arrangements.

American Express is known for its excellent customer service, and the Gold Card is no exception. There’s comfort in knowing that whether you’re dealing with a billing issue or need last-minute dinner reservations, support is just a moment away.

Comparison with Other American Express Cards

The American Express Gold Card is a standout player in the rewards card arena, but how does it stack up against its family members, like the Platinum or Green Card? Comparing their features side by side can help you decide which card might best suit your lifestyle and spending habits.

American Express Platinum Card:

- Targeted at: High-spending travelers seeking luxury travel benefits.

- Standout Perks: Access to airport lounges, elite status with hotel programs, and hefty annual travel credits.

- Annual Fee: Substantially higher than the Gold Card, reflecting its more extensive benefits.

For those who travel often and value luxury experiences, the additional cost of the Platinum Card could be justifiable.

American Express Green Card:

- Targeted at: Environmentally-conscious consumers with a focus on travel and dining.

- Standout Perks: Lower annual fee than Gold, travel and dining rewards, and eco-friendly initiatives.

- Rewards Structure: Offers points on travel, transit, and dining, but typically at lower rates than the Gold Card.

Those new to rewards cards or keen on a lower annual fee might find the Green Card’s value proposition appealing.

Head-to-Head Comparison Table:

Insider Tip: “Each American Express card caters to different needs. Compare the rewards structures and perks with your personal spending patterns and lifestyle to choose the best one for you.”

Conclusion:

For those whose spending naturally aligns with its bonus categories (dining and groceries – which is most of us) and who can make full use of the monthly dining credits and travel perks, the card is not just a luxury but a practical financial tool. Its rewards rates can transform typical expenditures into a path toward your next vacation, dining event, or epicurean treat.

With all the cards we have, this one is our “go-to” card for our daily spending, assuming that we are not working on a new welcome bonus. The earning potential for groceries could be 100k Membership Rewards points per year. This is on top of the 4x earning potential for dining. Stack this card with an online shopping portal, like Rakuten, and you have a good one-two combo to increase your points quickly.

Remember: The best credit card is one that fits seamlessly into your life, accentuating your spending habits and complementing your financial goals.