Traveling the world with your significant other can be one of life’s most thrilling experiences. But did you know you could immensely cut down on travel costs through a strategy known as Player 2 Mode? Many couples are using this strategy to travel in business and first-class flights, stay in luxurious hotel stays, and enjoy the benefits of airport lounges.

In this comprehensive guide, we’ll dive deep into the ins and outs of Player 2 Mode —a collaborative way for partners to compound their points and miles. Not only does this strategy offer double the sign-up bonuses and referral rewards, but it also allows for strategic pooling of points to stretch your travel dollars even further.

Whether you’re new to travel hacking or looking to optimize your approach, this article is your ticket to soaring high with travel rewards—hand in hand.

Table of Contents

ToggleUnderstanding Player 2 Mode

Before we embark on our strategic journey through the realm of points and miles, let’s clarify what we mean by Player 2 Mode. At its core, Player 2 Mode is a collaborative tactic where partners, be it spouses, long-term couples, or even close friends, systematically apply for credit cards and other points-earning opportunities in a way that maximizes bonuses and minimizes any potential negative impact on individual credit scores.

Each ‘player’ takes turns in applying for credit cards, harnessing sign-up bonuses, and racking up rewards, all while keeping an eye on the credit landscape and ensuring a healthy financial foundation. Imagine this like a well-coordinated dance, where each step is carefully planned and executed to create a stunning performance, or in this case, an incredible travel savings plan.

Here’s why this strategy is a game-changer for duos:

- Opportunities to earn double the sign-up bonuses.

- Harness referral bonuses by referring one another.

- Strategic redemption allows couples to book more complex travel itineraries.

- Reducing costs by sharing card benefits like companion passes and free hotel nights.

In the land of credit card rewards, two heads are definitely better than one.

The Basics of Points and Miles Strategies

Embarking on the journey to maximizing points and miles begins with understanding the fundamental building blocks of travel rewards. Whether you’re completely new to this world or looking for a refresher, the following insights will help make sure you’re on the right track.

Earning points and miles can come from a variety of sources:

- Credit Card Sign-Up Bonuses: This is often the fastest way to accumulate a large number of points or miles. Look for cards that align with your travel goals and spending habits.

- Everyday Spending: Use your rewards credit cards for daily expenses to accumulate points on things you’d buy anyway.

- Travel Bookings: Booking flights, hotels, and rental cars through the card’s travel portal or partners can yield higher points or miles per dollar spent.

- Promotions: Stay on the lookout for limited-time offers that grant additional points, like double points on dining or extra miles for shopping with specific retailers.

It’s critical to track your points so you have a record of how many points and miles you have, track your welcome bonuses, and give you tips on which card to use that will maximize your points and miles earnings. There are several apps and tools available to help manage multiple rewards accounts. Some platforms to consider include AwardWallet, CardPointers, and MaxRewards. Moreover, setting specific travel goals can help guide your earning and redeeming strategy, ensuring you utilize your points in the most effective way.

Setting Up Your Player 2 Strategy

Creating a winning strategy in Player 2 Mode isn’t just about applying for every credit card offer that is advertised on TV (hint – they are usually not the best cards). It’s about timing, communication, and finding the right deals that complement both of your spending habits and travel goals.

Picking the best credit cards is like crafting a fine-tuned instrument—it needs to suit your style and play the right notes for your travel symphony. Here’s how to ensure harmony in your Player 2 Mode strategy:

Crafting a Sign-Up Bonus Calendar:

- Plan Applications Around Big Purchases: If you know you have a major expense coming up, such as a home appliance purchase or your property tax payments, that’s an excellent time to apply for a new card and hit the minimum spend for bonuses.

- Stagger Applications: Don’t rush to apply for multiple cards simultaneously. Give each Player’s credit score time to recover after each new account. 90 days is a good rule to keep but that time schedule can be reduced in certain credit cards.

Other Player 2 Strategy Tips:

- Don’t Miss Minimum Spend Requirements: Missing out on a sign-up bonus because you fell a few dollars short is painful. Track your spending meticulously. Use credit card tracking apps to make sure you don’t miss out – yes, we’ve done it.

- Avoid Overspending to Earn Bonuses: Never spend more than you can pay off in full each month. Interest charges can quickly negate the value of any rewards earned.

- Assess Each Player’s Credit Health: Before diving in, both players should check their credit scores and reports. Look for any issues that might need addressing, such as incorrect information or past due accounts, as these can affect credit card approvals.

- Keep an Eye on Bonus Categories: If one card offers high rewards for groceries while another offers more for dining out, make sure to use each card strategically to maximize bonus points.

- Plan Your Credit Inquiries: Since every credit application can result in a small, temporary drop in your credit score, space out applications to give your score time to recover.

By following these tips and keeping a close eye on the details, you and your Player 2 can turn the credit card game into a profitable venture, setting sail toward your dream destinations faster than ever.

Leveraging Referral Bonuses

One of the most lucrative aspects of a well-orchestrated Player 2 strategy lies in capitalizing on referral bonuses. Referral programs offer a unique opportunity to earn additional rewards by inviting Player 2 to apply for a card you already hold.

Here’s how to master the referral game:

1. Understand the Referral Process: Most credit card companies have a referral program where you can invite friends and family to apply for a card. If they’re approved using your referral link, you’ll receive bonus points.

2. Coordinate with Player 2: Discuss who should refer whom for each new card application. This maximizes the bonuses across both accounts.

3. Spread Out Referrals Over Time: Instead of referring each other for multiple cards at once, space out referrals to align with your signup bonus calendar and spending capabilities.

4. Keep Track of Referral Bonuses: Make sure you follow up on received bonuses; occasionally, they may take a while to post to your account.

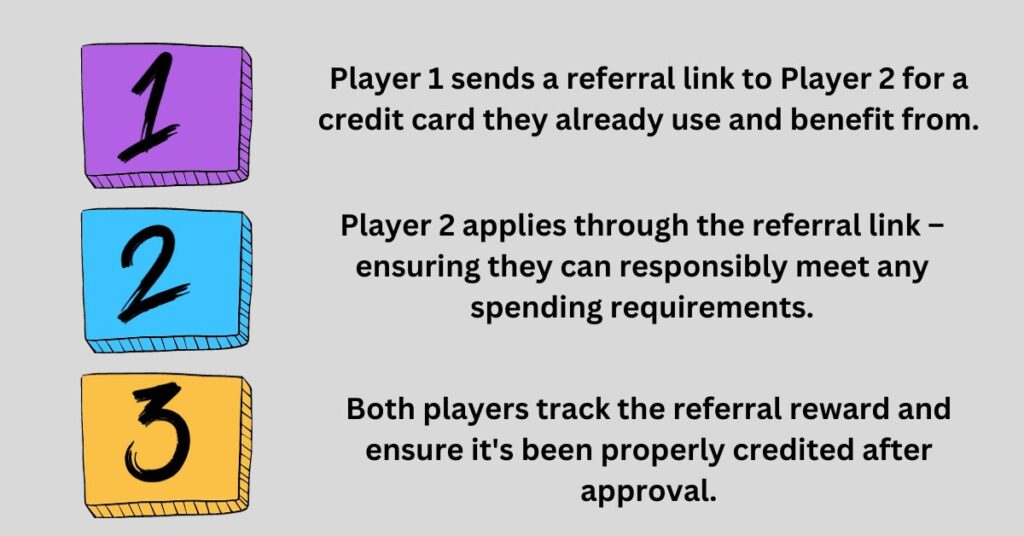

Step-by-Step Guide for Successful Referral Bonus Maximization:

Remember, the key is for both players to use the referral system strategically and responsibly. With each successful referral, you’re not just earning rewards; you’re building toward your next shared travel experience.

Did you know? Some credit card programs offer bonus points for referring new members beyond your Player 2, so consider referring friends and family members who are also interested in earning travel rewards.

As your points balance grows, it’s essential to stay on top of the best ways to redeem these points. That’s where a coordinated travel plan comes into play. Ready to create travel experiences that are not only memorable but also incredibly rewarding? Let’s discuss how to optimize your redemption strategy next.

Recommended Credit Cards for Player 2 Mode

When utilizing a Player 2 Mode strategy for travel credit cards as a couple, it’s important to consider cards that offer good welcome bonuses, as well as those that complement each other to maximize rewards from household spending. Here are some travel credit card recommendations that we have implemented in our “player 2” strategy:

Chase Sapphire Preferred

- Welcome offer – 60,000 points when you spend $4,000 in the first six months.

- Annual fee – $95

- Earn 3x points on dining

- Earn 3x point on streaming services

- No foreign transaction fee

This card offers valuable travel rewards and welcome bonuses, making them popular choices for couples looking to maximize their points and miles. The card is a good starting travel credit card to start and earns valuable Ultimate Rewards which can be transferred to several travel partners to fit your traveling needs. We’ve used this card when we first entered into Player 2 Mode strategy. To maximize the Ultimate Rewards, I referred my wife and I was able to get additional Ultimate Rewards points.

American Express Gold

- Welcome offer – 60,000 points when you spend $6,000 in the first six months.

- Annual fee – $250

- Earn 4x points on dining and supermarkets

- $120 dining credit

- No foreign transaction fee

The American Express Gold was another credit card we used in Player 2 Mode. American Express typically has increased sign us bonuses and the amount can be significantly more than their typical bonuses.

In our situation, one of us already had the American Express Gold Card. American Express increased the bonus to 90k and I then referred my wife. Not only did she get the bigger sign up bonus and I received a referral bonus, she was able to utilize the 4x dining and grocery benefits. Because of these benefits, we both intend to keep this card, despite the annual fees.

Chase Ink Business Preferred

- Welcome offer – 100,000 points when you spend $8,000 in the first three months.

- Annual fee – $95

- Earn 1x on all other purchases

- Earn 5x on Lyft Rides

- Cell Phone Protection

- No foreign transaction fee

The Chase Business Ink Credit Cards are our newest Player 2 Mode credit card plan, and is our TOP PICK. Currently, Chase has increased sign up bonuses for their Business Ink credit cards. But wait, don’t you have to have a business? Yes. But this is for another blog article…

The three Chase Business Ink credit cards are: the Ink Preferred, Ink Unlimited and the Ink Cash. These cards earn between 100k and 90k each. But the best part is the referral bonuses – 40k each. If P1 signs up for each of the cards and then refers P2 to each of the cards, then the total of Ultimate Rewards points would be over 720k points! Want to get away?

Conclusion

Navigating the world of travel rewards as a team can be incredibly rewarding. By leveraging the power of the Player 2 Mode strategy, couples can double their points and miles and in turn, redeem for travel opportunities at a fraction of the cost.

Remember, while the journey toward maximizing travel rewards can be intricate, the payoff is as sweet as the destinations awaiting you. So, embark on this adventure with your Player 2 by your side, and before long, you’ll be crafting travel tales worth telling for years to come.

Frequently Asked Questions (FAQs)

Q: Can both players in Player 2 Mode earn bonus points for the same spending categories?

A: Absolutely. If both players have cards that earn bonus points in the same categories, make sure to use the right card when making purchases in those categories to double up on earning potential.

Q: Should we apply for cards at the same time to travel together sooner?

A: While tempting, it’s smarter to stagger applications to manage spending requirements and to protect your credit scores from too many inquiries at once.

Q: How do we handle annual fees when we have multiple rewards credit cards between us?

A: Assess the value each card brings compared to its annual fee. If a card’s benefits outweigh the cost, it’s likely worth keeping. Always evaluate annually, as card benefits or your travel habits can change.